charitable gift annuity canada

A charitable gift annuity acquired through The Presbyterian Church in Canada allows you to give a substantial gift to your local congregation andor The Presbyterian Church in Canada and in return receive a regular income for life. Benefits of a charitable gift annuity.

Receive a charitable income tax deduction for the charitable gift portion of the annuity.

. A charitable gift annuity is an arrangement under which a donor transfers a lump sum to a charity in exchange for fixed guaranteed payments for the life of the donor andor another person or alternatively for a term of years. A charitable gift annuity provides you with fixed payments for life in exchange for a gift of cash or securities. In a nutshell a Charitable Gift Annuity is a contract that provides the donor a fixed income stream for life in exchange for a substantial donation to a charity.

But most important your Covenant House charitable gift annuity gives our kids a chance for a better life. Annuities are often complex retirement investment products. The Canadian Charitable Annuity Association CCAA is a voluntary association of charitable organizations and institutions interested in andor involved in the issuing of Charitable Gift Annuities.

A charitable gift annuity is known as a gift that gives back. A charitable gift annuity provides an immediate gift to CD. A charitable gift annuity CGA is a concept whereby a donor makes a gift of money or property to charity and the charity gives back an agreed-upon income stream to the donor for the remainder of their life or joint lives.

With a charitable gift annuity you agree to make a gift to OM through Link Charity and they in return agree to pay you and someone else if you choose a fixed amount each year for the rest of. Browse our site now. In essence Charitable Gift Annuities can be considered part investment and part charitable gift.

A charitable gift annuity is a compelling way to make a gift to Diabetes Canada and receive guaranteed income for life. All or a substantial portion. This is a tax effective plan for you as much of the income you receive from such an annuity is almost free of tax.

Ad Learn About Charitable Trends Behaviors and Priorities of High Net Worth Americans. Charitable Gift Annuities CGAs work the same way as regular commercial annuities but offer even more advantages because of a charitys tax-free status. A portion of the total contribution is used to purchase the annuity from a licensed insurance company and the balance is retained as a donation for which a tax receipt.

Update to Services in consideration of COVID-19. Learn some startling facts. A 70-year-old donor makes a 50000 contribution to UAlberta for a charitable gift annuity.

Howe Institute while providing a secured income stream for the donor during their lifetime. To further assist you below is a detailed explanation of the benefits of a Covenant. Link Charity is the number one distributor of charitable annuities Canada-wide because we are the only company that allows you to gift your annuity to as many charities as.

Canada T5J 4P6. A charitable gift annuity is a way to donate to a nonprofit and receive a stream of lifetime payments in return. A charitable gift annuity is an arrangement under which a donor transfers capital to a charitable organization in exchange for immediate guaranteed payments for life at a specified rate depending on life expectancy or for a fixed term.

Heart and Stroke Foundation of Canada Charitable Registration. The charitable gift annuity is a popular planned giving instrument for elder Canadians as it allows a person to make a significant contribution while maintaining financial security. The CCAA works cooperatively with its members to set standards self monitors the ethical and technical aspects of charitable fund-raising specifically relating to.

It can be especially appealing to individuals aged 70 or older who wish to make a gift to Diabetes Canada and turn their taxable interest income from savings into substantially tax-free income. A complete list of the new rates can be found on ACGAs website. Ad A Significant Portion Of The Annuity Payment Will Be Tax Free Over A Number Of Years.

A charitable gift annuity is a good investment for people 65 and over who seek a secure income during their lifetime and want. It is a thoughtful gift that gives back. One widely overlooked strategy deserves special attention from generous baby boomers and other individuals who want to reduce their taxes -- make a significant gift to a charity and enhance income during their lifetime through a charitable gift annuity.

There are many benefits of a gift annuity. In consideration of provincial and federal guidelines Gift Funds Canada will have limited staff and office hours starting in September 2020. A Charitable Gift Annuity is a gift vehicle and when combined with a Gift Funds Canada Donor Advised Fund enables a donor to make a charitable gift during their lifetime without jeopardizing their access to supplemental income both now and in the future.

Ad Get this must-read guide if you are considering investing in annuities. Get what you are looking for. In turn you receive an income stream for life.

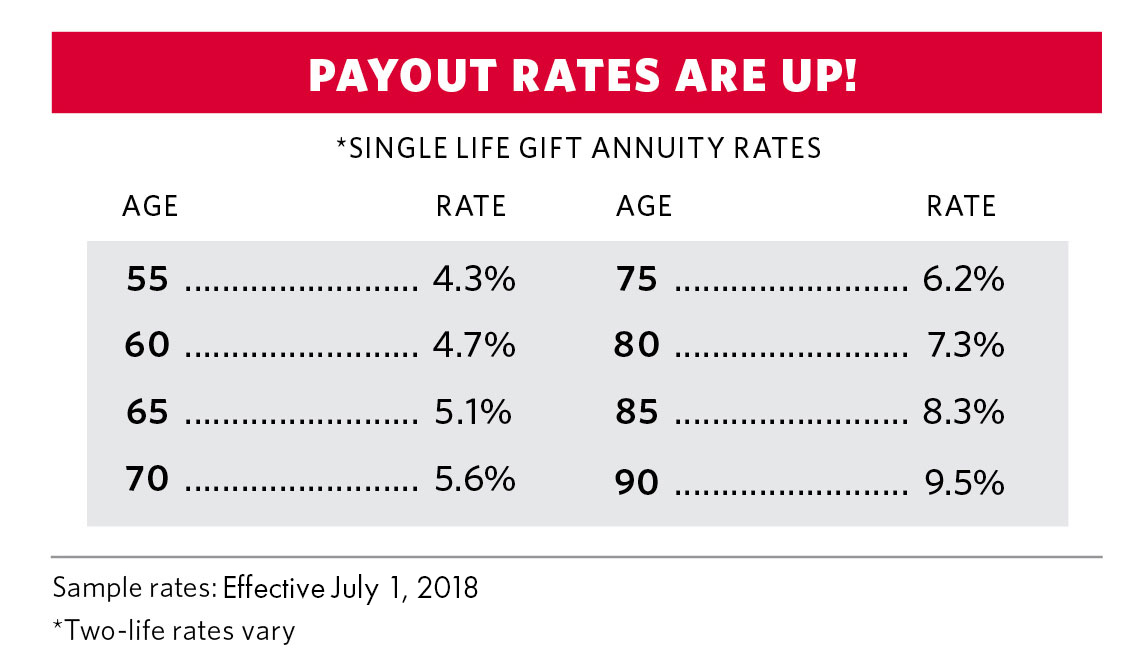

A 75-year- old who establishes a charitable gift annuity after July 1 2020 will receive an annual payout of 54 which is down from 58 on January 1 of this year. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. He receives tax-free payments of 2250 annually for the rest of his life.

The amount of your annuity is determined by the size of your contribution your age and the interest rate environment. The charity normally purchases the annuity through an annuity broker like ourselves and specifies the guarantee period if any and for life. The remainder is used to further the mission of Brandeis University.

Payment rates depend on several factors including your age. Gift annuity payouts for annuitants 90 years of age and older will cap at 86. It has two parts.

An upfront immediate gift to the Heart Stroke for which you will receive an immediate. At Link Charity Canada you can place a sum of money into an annuity to be invested and managed through your lifetime then benefit the charitable organizations of your choice upon your passing. Depending on the donors age this income can be tax-free.

Donors must be at least 60 years old. If the actuarial value of the annuity is less than the value of the property transferred then the difference in value. Bank of America Private Bank Is Here to Help with Your Philanthropic Goals.

A Charitable Gift Annuity allows individuals and couples with a higher than average investment income to support a cause that is near and dear to their heart while paying them back for life. Link Charity is the number one distributor of charitable annuities Canada-wide because they are the only company that allows you to gift your annuity to as many charities as you wish. His charitable gift to UAlberta equals 12500 the 50000 contribution minus 37500 - the cost to purchase the annuity.

Any money left in the annuity when you die goes to the charity. Claremont McKenna College Offers Attractive Gift Annuity Rates And Secure Payments. A charitable gift annuity might be something to consider.

You make a donation to Citadel Foundation and in return for your donation Citadel Foundation will purchase an annuity from a life insurance company. A gift annuity allows you to make a significant gift yet still enjoy the income from that gift. A Charitable gift annuity is a way to guarantee an income for yourself while also making a gift to a charity.

Contribute To A Fund Jewish Foundation Of Greater Toronto

Charitable Gift Annuity The Christian School Foundation

Canadian Charitable Annuity Association

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Charitable Annuity Benefits Of A Charity Gift Annuity Link Charity

Canadian Charitable Annuity Association

Gift Estate Planning Sfu Advancement Alumni Engagement

Charitable Gift Annuity Focus On The Family

Charitable Gift Annuity Partners In Health

Charitable Gift Annuity Focus On The Family

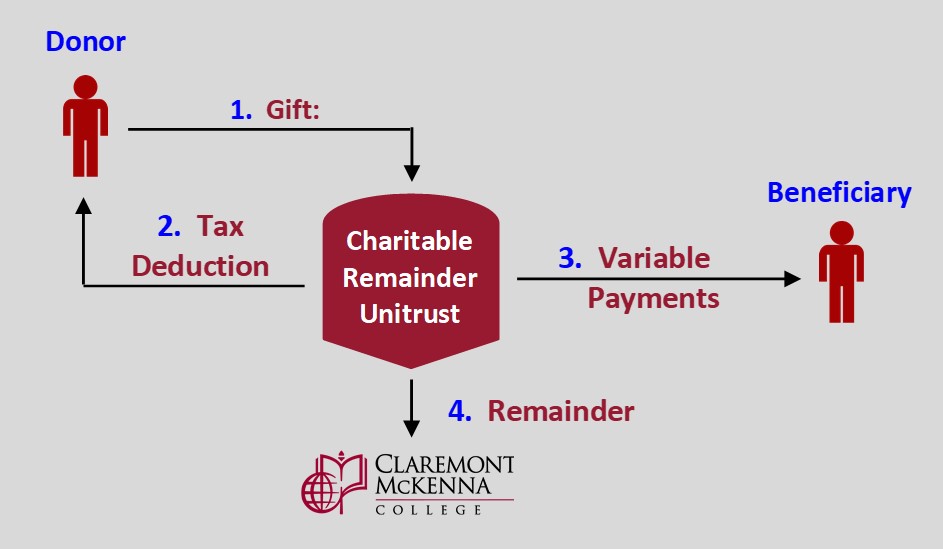

Charitable Remainder Unitrust Claremont Mckenna College

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Http Www Valamohaniyercharitabletrust Com Annadan Html Free Food Providing Functions Are Every Month Amavasai Trust Words Charitable Charity Organizations

It S Raining Crats And Dogs Creative Planning

Charitable Gift Annuities Studentreach

Ways Of Giving Charitable Gift Annuities The Presbyterian Church In Canada

Charitable Gift Annuities Are On The Rise Barron S

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust